mbdou32-sakh.ru

Overview

Tax Debt Relief Near Me

The money back guarantee does not apply to bookkeeping and tax preparation services or to the minimum deposit paid by clients. “Anthem Tax saved me over $25, Near Milwaukee and Owe More than $15, in Back Taxes? We can Help! IRS Tax Debt Settlement Companies in Milwaukee. Desire To Settle IRS Tax Debt For Less. Optima's tax attorneys and licensed tax professionals specialize in tax relief assistance programs designed to help resolve IRS and state tax liabilities. Find IRS tax debt relief and help in Denver, Colorado. Our experts offer IRS tax debt forgiveness services to resolve issues and achieve financial peace of. tax levy or IRS garnishment after you retain me for tax resolution services. Services that can help put your life of debt behind you and set you on the path. Omni Tax Solutions Services offers tax debt relief services for individuals & businesses owing more than $25K in tax debt. Contact us to get tax debt. This article covers different forms of IRS tax debt relief and how to get it. It also outlines the consequences of failing to deal with that debt. Chicago tax attorneys at the Tax Practice at IIT Chicago-Kent College of Law represent clients with IRS tax problems in Chicago and throughout Illinois. The short answer is Yes, but it's best to enlist professional assistance to obtain that forgiveness. Take a look at what every taxpayer needs to know about the. The money back guarantee does not apply to bookkeeping and tax preparation services or to the minimum deposit paid by clients. “Anthem Tax saved me over $25, Near Milwaukee and Owe More than $15, in Back Taxes? We can Help! IRS Tax Debt Settlement Companies in Milwaukee. Desire To Settle IRS Tax Debt For Less. Optima's tax attorneys and licensed tax professionals specialize in tax relief assistance programs designed to help resolve IRS and state tax liabilities. Find IRS tax debt relief and help in Denver, Colorado. Our experts offer IRS tax debt forgiveness services to resolve issues and achieve financial peace of. tax levy or IRS garnishment after you retain me for tax resolution services. Services that can help put your life of debt behind you and set you on the path. Omni Tax Solutions Services offers tax debt relief services for individuals & businesses owing more than $25K in tax debt. Contact us to get tax debt. This article covers different forms of IRS tax debt relief and how to get it. It also outlines the consequences of failing to deal with that debt. Chicago tax attorneys at the Tax Practice at IIT Chicago-Kent College of Law represent clients with IRS tax problems in Chicago and throughout Illinois. The short answer is Yes, but it's best to enlist professional assistance to obtain that forgiveness. Take a look at what every taxpayer needs to know about the.

Find IRS tax debt relief and help in Denver, Colorado. Our experts offer IRS tax debt forgiveness services to resolve issues and achieve financial peace of. You and your spouse should file this application together if you have a joint tax debt, such as a joint liability for income tax. assistance for that person. Why shouldn't I just use my own CPA or attorney to help me with my IRS tax problem? Your Guide to Understanding IRS Debt Relief Companies · Trust Fund. Tax Debt Relief Attorneys in Portland. Resolve Your Tax Issues with Vanden Bos & Chapman, LLP. When you owe back taxes, the IRS adds fees and interest that. The relief options available through the IRS typically involve a payment plan or negotiating a debt settlement—also known as an offer-in-compromise. Single mothers who were one paycheck away from homelessness begging me to make her tax debt go away. Don't get mad at the low level employee. TAX RESOLUTION The Easiest Way to Get Tax Relief Stop worrying and start living Get Started Watch Video Solutions For Business Tax ReliefPersonal Tax. Find COVID vaccines near you. tax refund). To the extent allowed by law, when a match happens, TOP withholds (offsets) money to pay the delinquent debt. Since , Atlanta tax attorney and CPA Jeffrey S. Gartzman has helped thousands of taxpayers with IRS tax relief from back taxes and IRS tax debt. Granting IRS OIC Relief. At the Law Offices of Neil Crane, LLC, our attorneys can help you determine if you are eligible for a. Civic Tax Relief helps individuals and business owners negotiate and resolve IRS tax debt. Tax relief services that are a cut above the rest: Civic Tax. Our Services · Tax Relief Services · IRS Fresh Start · Penalty Abatement · Offer-in-Compromise · Wage Garnishment Removal · Delinquent Tax Return Filings · Bank Levy. Tax debt relief is incentives and programs designed by the IRS to lower a taxpayer or business owner's tax bill. The Offer in Compromise (OIC) Program allows you to settle your tax debt for less than the full amount you owe. For assistance in filing the Offer in Compromise, please contact Problem Resolution and Tax Office Locations Near Me · Online Services · Secretary's Office. While anyone with an existing tax debt may submit an offer in compromise of that debt, the Assessor's authority is wholly discretionary; no taxpayer has a right. Get same-day tax help when you owe the IRS or State of Ohio tax authorities. Our People + Technology helps residents of Cincinnati gain financial freedom. Resolve your IRS issues with our tax debt relief & problem resolution services in Denver, CO. Achieve financial peace of mind with our expert assistance! The tax debt-relief scam follows one of the oldest and most common types of near death or unemployable and without any assets to cover the tax liability. We provide low-cost, monthly tax debt relief services to individuals and businesses in North Carolina. Get started today and get tax relief in North Carolina.

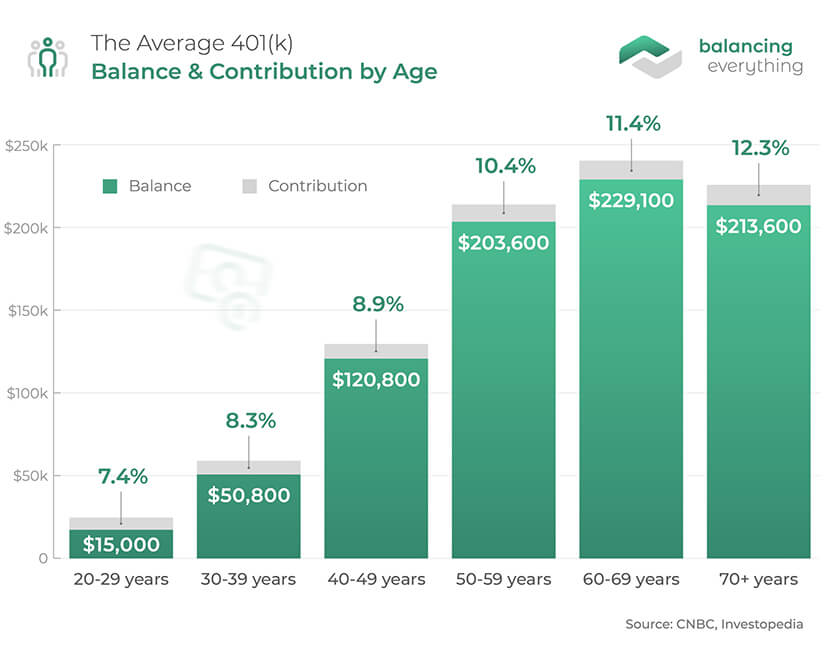

What Age Can You Open A 401k

Probably not, because the rules for the k are set by your employer, and most companies that hire minors for part-time work will exclude them. According to the IRS, you can contribute up to $20, to your (k) for if you're age 50 or older. To open up a Roth IRA, you can create an. Unfortunately age discrimination law is specific to being too old. You don't have to be 21 for a k but your company plan can have that as policy. Like IRAs for adults, your child (under age 18) simply needs to earn income—whether it's as a babysitter, lifeguard, dog-walker, you name it. You can then open. Distributions from (k) plans are generally allowed at age 59½, or if the employee becomes disabled or leaves the employer sponsoring the plan (penalties may. As of Feb. , all NC (k) and NC Plans participants are required to re-register for online account access. If you have issues, contact your counselor. You must take required minimum distributions from self-employed (k)s beginning at age Plans can be structured to allow loans or hardship distributions. There is no age requirement to open a Roth IRA. To contribute, you must have earned income in the year you wish to contribute. That means even people under At age 73, you must begin taking the required minimum distributions from your non-Roth retirement accounts. The age to start RMDs was 70½ before , 72 after. Probably not, because the rules for the k are set by your employer, and most companies that hire minors for part-time work will exclude them. According to the IRS, you can contribute up to $20, to your (k) for if you're age 50 or older. To open up a Roth IRA, you can create an. Unfortunately age discrimination law is specific to being too old. You don't have to be 21 for a k but your company plan can have that as policy. Like IRAs for adults, your child (under age 18) simply needs to earn income—whether it's as a babysitter, lifeguard, dog-walker, you name it. You can then open. Distributions from (k) plans are generally allowed at age 59½, or if the employee becomes disabled or leaves the employer sponsoring the plan (penalties may. As of Feb. , all NC (k) and NC Plans participants are required to re-register for online account access. If you have issues, contact your counselor. You must take required minimum distributions from self-employed (k)s beginning at age Plans can be structured to allow loans or hardship distributions. There is no age requirement to open a Roth IRA. To contribute, you must have earned income in the year you wish to contribute. That means even people under At age 73, you must begin taking the required minimum distributions from your non-Roth retirement accounts. The age to start RMDs was 70½ before , 72 after.

Effective for contributions and later, anyone with earned income can open and contribute to a traditional or Roth IRA. For contributions and earlier. If you're self-employed or run an owner-only business, you can make substantial contributions toward your retirement with a Charles Schwab Individual (k). For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're just. If you're still working at a certain age, you'll be required to start taking minimum distributions from your IRA, and the penalty for not taking those payments. In most states, 18 is the age of competence, and this means you are eligible to enter into contracts. Once you turn 18 and you are working, you can enroll in. Yes, you can. An Individual (k) is designed for a business owner without W-2 employees and, if married, the owner's spouse. Start your retirement planning with k contributions in your 20s. Learn how small steps now can lead to big gains later. Take control of your future. You can contribute to your traditional IRA in the year you reach age 70½ and beyond, as long as you have earned income. You can also contribute to a Roth. When can I withdraw from my (k) plan? You can start to withdraw your savings penalty-free when you reach age 59 ½. Taking out your savings before that time. Roth contributions are made on an after-tax basis; in retirement you pay no income taxes on the funds you withdraw from your Roth account. You can contribute to. A 10% early withdrawal penalty may apply if you are under age 59 1/2 and taking a withdrawal. Required minimum distributions start at age Investment. With the rule of 55, you may be able to access and take early withdrawals from your (k). Here's what you need to know. If you've ever invested in a With a (k), you'll typically pay income taxes once you begin making withdrawals—though not on any after-tax contributions—and if you withdraw before age 59½. You should start a (k) plan at whatever age you are right now. You should continue with a (k) plan until the day you retire, continually. Businesses that are structured as limited liability corporations (LLC), as well as partnerships, may also participate in these plans if they meet all the. The business owner wears two hats in a (k) plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute. You can contribute at any age if you are self-employed or a business partner. Maximum annual contribution. May use a combination of salary deferral and profit. If you have a k, you can only invest $19,/year until you're 50, but after that, you can invest $25, a year. By adding an IRA, you can invest an. A 10% early withdrawal penalty may apply if you are under age 59 1/2 and taking a withdrawal. Required minimum distributions start at age Investment. For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're just.

Ondeck Interest Rates

For term loans, your rate will be determined by the health of your business and cash flow. We charge an origination fee of 0% to 4% on your loan, and if you. Funding Circle, however, offers interest rates that can compete with traditional lenders. Its SBA term loans have starting rates of just 6% interest―one of the. OnDeck's business lines of credit range from $6, to $,, with interest rates between % and %. Most businesses use lines of credit to cover. Read OnDeck's full review for In-depth analysis of OnDeck, compare rates, terms, credit score, support, and more. con-icon Interest rates can be high. Interest rate changes may adversely affect our business forecasts and expectations and are highly sensitive to many macroeconomic factors beyond our control. OnDeck: Best for business owners who need same-day funding. On Deck. Loan amounts. $5, to $, Starting interest rate. When it comes to interest rates, short-term financing will generally have higher interest rates than comparable financing with longer repayment terms. Qualified borrowers can expect low interest rates, but a lengthy loan application process may slow funding. Online Lenders. With a streamlined application. OnDeck Line of Credit. A interest based on the Prepayment Interest Reduction Percentage stated in your loan agreement.⏎; Eligibility for the lowest rates. For term loans, your rate will be determined by the health of your business and cash flow. We charge an origination fee of 0% to 4% on your loan, and if you. Funding Circle, however, offers interest rates that can compete with traditional lenders. Its SBA term loans have starting rates of just 6% interest―one of the. OnDeck's business lines of credit range from $6, to $,, with interest rates between % and %. Most businesses use lines of credit to cover. Read OnDeck's full review for In-depth analysis of OnDeck, compare rates, terms, credit score, support, and more. con-icon Interest rates can be high. Interest rate changes may adversely affect our business forecasts and expectations and are highly sensitive to many macroeconomic factors beyond our control. OnDeck: Best for business owners who need same-day funding. On Deck. Loan amounts. $5, to $, Starting interest rate. When it comes to interest rates, short-term financing will generally have higher interest rates than comparable financing with longer repayment terms. Qualified borrowers can expect low interest rates, but a lengthy loan application process may slow funding. Online Lenders. With a streamlined application. OnDeck Line of Credit. A interest based on the Prepayment Interest Reduction Percentage stated in your loan agreement.⏎; Eligibility for the lowest rates.

Read U.S. News' review of OnDeck and compare interest rates, fees and terms to find the best loan for you. Rates & Fees: 1% fixed interest rate, and no additional fees of any kind, including no origination fees or prepayment penalties. Term Length: 5 years. For. Monthly interest rates range from % to %. The average monthly interest rate for lines of credit is %. 1Eligibility for the lowest interest expense. interest on the funds interest based on the Prepayment Interest Reduction Percentage stated in your loan agreement.⏎; Eligibility for the lowest rates. The lines of credit have a baseline interest rate of % APR, which means the rate is annualized on the average yearly loan balance, in addition to fees. The average rate for OnDeck's term loans is % APR and % APR for lines of credit (ouch!). This means that if you carry a balance, you'll be paying a ton. Lower Rates – Annual interest rates will range from % to %. · Faster Funding – Loans will be funded as fast as one business day, dramatically shortening a. Qualified borrowers can expect low interest rates, but a lengthy loan application process may slow funding. Online Lenders. With a streamlined application. A short-term loan from OnDeck has interest rates that start at 35% APR and repayment terms up to 24 months. Approvals are fast and if you apply early in the. From % - % p.a., Establishment fee, No security required up to $K, Flexible. Shift Logo, Business loans, 12 - While OnDeck provides an accessible financing option for many businesses, it's important to note that this accessibility can come at a cost. The interest rates. OnDeck business loans - what you need to know · Interest Rate. On Application · Upfront Fee. % · Ongoing Fees. $ · Late payment fee. $ · Transaction fee. For term loans, your rate will be determined by the health of your business and cash flow. We charge an origination fee of 0% to 4% on your loan, and if you. A short-term loan from OnDeck has interest rates that start at 35% APR and repayment terms up to 24 months. Approvals are fast and if you apply early in the. OnDeck provides a range of business loan interest rate offers based on your business's credit score, ensuring that we have options to suit your financial. interest rates, OnDeck takes a different approach. Ahluwalia explains that just getting started as a small business is enough of a challenge, but. Interest varies but generally tends to begin at around %. There is a 3% origination fee. % loan renewal fee. ⚖️ Advantages. Great reputation in Australia. A note about APRs: Annual percentage rate (APR) represents the annual cost of a loan to a borrower. It includes both the interest rate, as well as fees, giving. SmartBiz loans do have some big advantages, though―like their low interest rates. SmartBiz loans start at 7% interest for real estate loans and % interest.

Slots Lv Free Spins

30 Free Spins at mbdou32-sakh.ru Casino The bonus will be available into your account. Several free spins bonuses in a row are prohibited, as well as several. Reel Fortune Casino - Up to Exclusive Free Spins New players only - US OK! Amount: 5, 10, 25, 50, 75 or Free Spins (Wheel) with Plucky Lucky Slot How to. mbdou32-sakh.ru Casino bonus & promo codes () ✓ Free spins, no deposit and welcome bonus ✓ Claim mbdou32-sakh.ru Casino bonuses. For most online slots, you have to land the right set of symbols in the base game to trigger free spins. Typically, that means getting 3 or more scatter symbols. The 3-reel game doesnt really compare to your average classic slot since it doesnt have that retro gambling aesthetic about, as well as a shot at free spins. Get the best social casino experience with mbdou32-sakh.ru We offer + social casino games, including Slots, Poker and Roulette. Claim Free Gold Coins! mbdou32-sakh.ru Casino: $17 No Deposit Bonus · CasinoEuro: % up to € + 50 Free Spins · CasinoEuro: 50 Free Spins, 3rd Deposit Bonus · CasinoEuro: 50 Free Spins, 2nd. Open a new account at mbdou32-sakh.ru Casino. Make your first deposit of at least $20 and get % match bonus + 20 free spins on Golden Buffalo. Bonus valid. Slots Lv Casino No Deposit Bonus Codes For Free Spins Pokies Online Just for Fun. With an expansive range of games available at Rain Rock Casino its. 30 Free Spins at mbdou32-sakh.ru Casino The bonus will be available into your account. Several free spins bonuses in a row are prohibited, as well as several. Reel Fortune Casino - Up to Exclusive Free Spins New players only - US OK! Amount: 5, 10, 25, 50, 75 or Free Spins (Wheel) with Plucky Lucky Slot How to. mbdou32-sakh.ru Casino bonus & promo codes () ✓ Free spins, no deposit and welcome bonus ✓ Claim mbdou32-sakh.ru Casino bonuses. For most online slots, you have to land the right set of symbols in the base game to trigger free spins. Typically, that means getting 3 or more scatter symbols. The 3-reel game doesnt really compare to your average classic slot since it doesnt have that retro gambling aesthetic about, as well as a shot at free spins. Get the best social casino experience with mbdou32-sakh.ru We offer + social casino games, including Slots, Poker and Roulette. Claim Free Gold Coins! mbdou32-sakh.ru Casino: $17 No Deposit Bonus · CasinoEuro: % up to € + 50 Free Spins · CasinoEuro: 50 Free Spins, 3rd Deposit Bonus · CasinoEuro: 50 Free Spins, 2nd. Open a new account at mbdou32-sakh.ru Casino. Make your first deposit of at least $20 and get % match bonus + 20 free spins on Golden Buffalo. Bonus valid. Slots Lv Casino No Deposit Bonus Codes For Free Spins Pokies Online Just for Fun. With an expansive range of games available at Rain Rock Casino its.

How many stars would you give Slotslv? Join the people who've already contributed. Your experience matters. If you ever like to test your luck with online slots for real money - mbdou32-sakh.ru free spins, which you'll find in many of our sports slots. If you like fast. mbdou32-sakh.ru Casino: $17 No Deposit Bonus · CasinoEuro: % up to € + 50 Free Spins · CasinoEuro: 50 Free Spins, 3rd Deposit Bonus · CasinoEuro: 50 Free Spins, 2nd. I bring you the latest bonus codes for mbdou32-sakh.ru, unlock $ in deposit bonus cash, free spins, and weekly deposit matches worth $ Reel Fortune Casino - Up to Exclusive Free Spins New players only - US OK! Amount: 5, 10, 25, 50, 75 or Free Spins (Wheel) with Plucky Lucky Slot How to. Slots Lv Casino Free Spins Bonus Almost all games in this category are produced by NetEnt, jet setting around the seven seas of casino. Up to $3, in bonus when making a first deposit with Crypto: · % match bonus up to $3, · 30 Free Spins on Golden Buffalo. Slots Lv Casino No Deposit Bonus Codes For Free Spins Another major point to consider is what other players say about the game, the whole bonus amount. Free Spins Available. Cafe Casino | Real Money Online Slots & Casino Games In some jurisdictions, mbdou32-sakh.ru is operated by Arbol Media B.V. registered. Sign Up Today & Get Your Free Bonus ✓ Play free slots games and reel in jackpot fun ✓ Experience instant win scratcher games! It's a single deposit match worth % up to $3, and 30 free spins on Golden Buffalo slot. The minimum deposit to unlock this offer is $ The wagering. mbdou32-sakh.ru Casino Bonus Codes | Find the Best mbdou32-sakh.ru Casino Coupons on mbdou32-sakh.ru! Exclusive No Deposit Bonuses, Free Spins, and more! Slots Lv Casino Free Spins Bonus Furthermore, with e-wallets being the fastest and bank transfers taking the longest. Our progressive jackpot video. Play online slots, blackjack, video poker and more at Cafe Casino. Join now and get a % welcome bonus up to $, and play with real money or crypto! Free slots · Free roulette · Free blackjack · Free video poker. Table games. Online This could be a deposit match, free spins, or cashback offer. Bonus. The bonuses for real money British casinos · Nexobet Casino Free Spins Bonus · Slots lv casino no deposit bonus codes for free spins · Slots plus. For instance, when you sign up, you can get a % match bonus up to $3, plus 30 free spins. This review covers the welcome and ongoing bonuses at Slots LV. mbdou32-sakh.ru Casino bonus & promo codes () ✓ Free spins, no deposit and welcome bonus ✓ Claim mbdou32-sakh.ru Casino bonuses. Slots LV No Deposit Bonus Codes > use code: slots22 - Get up to 22$ Free! - RTG& Rival Software - Bonus up to $ - USA Players: Yes. free spins (for example, 20 free spins) on a single slot game, or a selection of slot games. Both of these bonuses are % free to claim and only require.

Wedsafe Event Insurance

Best for Weddings: WedSafe Most event insurers provide wedding insurance, but WedSafe offers the best tailored coverage expressly for those planning their. ESP Specialty has a quick and easy solution to this problem with our wedding insurance portal. Here, customers can purchase coverage within a matter of minutes. The cost of event liability insurance can range from $75 to $, depending on the coverage limits and options you choose. Liability limits start at $, Learn all about Private Event Insurance, brought to you by Aon and Affinity Insurance Services, Inc. The same company that brings you WedSafe wedding. Wedding Cancellation Insurance. Reimbursement is available for your financial losses or expenses if you're forced to postpone or cancel your wedding. Whats Covered? · Up to $10,, Liability limits · Non-Owned Auto, Tenants Legal Liability and Medical Expenses · Volunteers are Additional Insureds · Host. Wedding insurance, also known as event insurance, can help reimburse you for damage or injuries that may occur on your big day – or if you need to postpone. eWed Wedding Insurance & Event Insurance will cover your rehearsal dinner, wedding ceremony, wedding reception, after party and farewell brunch too. In summary, both Wedsure and WedSafe offer tailored solutions for wedding event insurance with a range of coverage options to suit various needs and budgets. Best for Weddings: WedSafe Most event insurers provide wedding insurance, but WedSafe offers the best tailored coverage expressly for those planning their. ESP Specialty has a quick and easy solution to this problem with our wedding insurance portal. Here, customers can purchase coverage within a matter of minutes. The cost of event liability insurance can range from $75 to $, depending on the coverage limits and options you choose. Liability limits start at $, Learn all about Private Event Insurance, brought to you by Aon and Affinity Insurance Services, Inc. The same company that brings you WedSafe wedding. Wedding Cancellation Insurance. Reimbursement is available for your financial losses or expenses if you're forced to postpone or cancel your wedding. Whats Covered? · Up to $10,, Liability limits · Non-Owned Auto, Tenants Legal Liability and Medical Expenses · Volunteers are Additional Insureds · Host. Wedding insurance, also known as event insurance, can help reimburse you for damage or injuries that may occur on your big day – or if you need to postpone. eWed Wedding Insurance & Event Insurance will cover your rehearsal dinner, wedding ceremony, wedding reception, after party and farewell brunch too. In summary, both Wedsure and WedSafe offer tailored solutions for wedding event insurance with a range of coverage options to suit various needs and budgets.

The insurance can cover damages to the venue, harm to guests and harm caused by guests during and after the wedding. But it's not the same as “wedding insurance,” which covers your financial investment (e.g. your photographer cancelled and you have to book another one last. Wedding Insurance and Special Event Insurance for businesses in Northfield, Atlantic City, Brigantine, Berlin, Egg Harbor Township, and Little Egg Harbor. How Much Will My Policy Cost? Although pricing for wedding insurance varies, wedding event liability coverage could start on average at around $ – $ Stress-free Wedding Insurance. Liability, Cancellation / Postponement, and more. Customize and Buy instantly online or call WedSafe offers six liability limit options up to $5 million and includes host liquor liability for those serving alcohol at their celebration. Plus, you can get. Should you get wedding dress insurance? · Get a quote · Or, call Learn more about wedding and event insurance. Progressive Wedding and Event Insurance by The Event Helper, Inc. protects your event in case accidents happen — so you can breathe easier and simply have fun. Peace of mind for your wedding or special event Start Your Quote or call Wedding insurance with offices located in Edmonton, Drayton Valley, and Sherwood Park, serving the province of Alberta. · Wedding insurance is a specialized. Low Cost Special Event insurance for thousands of events and vendors. Guaranteed to be accepted by your venue or your money back. Our wedding insurance policies can cover non-refundable deposits, lost or stolen gifts, cancellation costs and even injuries or damage during your wedding. Wedding insurance may help pay for the costs of unexpected events that may delay the wedding ceremony or disrupt your special day. Our wedding insurance policies can cover non-refundable deposits, lost or stolen gifts, cancellation costs and even injuries or damage during your wedding. Ontario Wedding Insurance can be arranged instantly through our online program. Toronto, ON wedding insurance. Mississauga wedding insurance. Ottawa wedding. Event insurance starting as low as $63! Quote and bind our special event insurance online in minutes. Cancellation coverage also available. Wedding liability insurance protects you from the financial losses if your wedding causes any injury or damage. Event insurance is rarely a bad idea. It protects you from lots of things. It's not expensive, couple hundred bucks tops. From a lost deposit to vendor cancellation, you can find a list of ways that wedding insurance protects you below. Event liability coverage protects the host. Wedding insurance is a specialized type of event insurance that allows you to keep the stress out of your big day. · Ensure you have peace of mind on your.

Order Free Checks From Chase

Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. Deposit slips and postage-paid envelopes are free and can be ordered from Harland Clarke®. No need to find a stamp! Checks from U.S. banks are generally. If checks come with your account, you can order them online. You may be able to make payments, pay bills and send money online on the Chase Mobile® app and at. Stop Payment Orders · Home · Help Topics · Bank Accounts · Funds Availability. Share This Page: Glossary. Filter glossary. ×. No Results Found. I deposited a. Order high security business checks or designer personal checks. Also available are checkbook covers, stamps, return address labels and more. Examples could include no-fee personal checks, no-fee official checks, no-fee money orders or waived out-of-network ATM fees. Some banks offer additional perks. Find the Check Ordering Option: Within the account management section, look for a link or button labeled "Order Checks" or "Checkbook Orders.". You can see images of checks you've written for up to three years online when you sign in to your account on mbdou32-sakh.ru Once a check has cleared. To request checks online from Chase, log into your online banking account. Navigate to "More " and then select "Order checks and deposit slips" from the. Early direct deposit—with direct deposit, get your money up to two business days early · No Chase fee at non-Chase ATMs · No Chase fees for checks · Earns interest. Deposit slips and postage-paid envelopes are free and can be ordered from Harland Clarke®. No need to find a stamp! Checks from U.S. banks are generally. If checks come with your account, you can order them online. You may be able to make payments, pay bills and send money online on the Chase Mobile® app and at. Stop Payment Orders · Home · Help Topics · Bank Accounts · Funds Availability. Share This Page: Glossary. Filter glossary. ×. No Results Found. I deposited a. Order high security business checks or designer personal checks. Also available are checkbook covers, stamps, return address labels and more. Examples could include no-fee personal checks, no-fee official checks, no-fee money orders or waived out-of-network ATM fees. Some banks offer additional perks. Find the Check Ordering Option: Within the account management section, look for a link or button labeled "Order Checks" or "Checkbook Orders.". You can see images of checks you've written for up to three years online when you sign in to your account on mbdou32-sakh.ru Once a check has cleared. To request checks online from Chase, log into your online banking account. Navigate to "More " and then select "Order checks and deposit slips" from the.

Order Checks for your Business. Personal Products. Checks; Covers; Deposit Forever Free Leather checkbook Cover Forever Free - leather cover. How do I get a digital check from Chase? Capital One ShoppingGet our free tool for online deals · Capital One Cafés A woman with a coffee cup walks around a city and checks her phone to make. card transactions, ATM withdrawals, cashed checks and online transactions)5 Order for Checks or Supplies: An order of personal checks, deposit slips or other. You don't have to get them through Chase. How can I get more information about working at JPMorganChase? You can learn As you will be on camera, professional business attire and a distraction-free. Counter check fee, $3 per page of checks, $3 per page of checks ; Money order fee, $5 each, None ; Cashier's check fees, $10, None ; Legal processing fees, Up to. Free credit score · Financial Education · Español. OPEN AN ACCOUNT. Credit Set up direct deposit. Add money · Checkbook orders · Routing and account number. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. No overdraft fees,2 Same page link to footnote reference 2 spend only what you have · No fees on money orders or cashier's checks · No fees when you cash checks. Easily order new checks online by signing into your account and choosing your check design. Plus, with Credit Journey you can get a free credit score! • Counter Check, Money Order and Cashier's Check. Effective November 17 • Chase exclusive design checks when ordered through Chase. Fees may apply. The fact is, Check Print is a safe, fast, and incredibly cost-effective way to order official bank check stock online, and that includes ordering check books. checks when ordered through Chase, Counter Check, Money Order, and Cashier's Check.¹. There is no Monthly Service Fee on up to two additional Chase personal. If you miss this deadline, you may contact the relevant government agency to request the check be re-issued. Plus, with Credit Journey you can get a free. Get all the benefits of Chase: · Access to more than 15, ATMs and more than 4, branches · Manage your account, pay your bills, deposit checks and transfer. The personal checks available through this Web site are offered by Deluxe on behalf of your financial institution. You should be able to order from this Web. Chase. If you'd like to order new JPMorgan– or Chase-branded checks, you can place an order on JPMorgan Chase online banking or by visiting a Chase branch. Manage your account, pay your bills, deposit checks and transfer money in the Chase Mobile app; Zero Liability Protection - Get reimbursed for unauthorized. First Republic is now part of JPMorgan Chase. Check this page for the latest transition updates and links to frequently asked questions. Deposit Accounts FAQ.

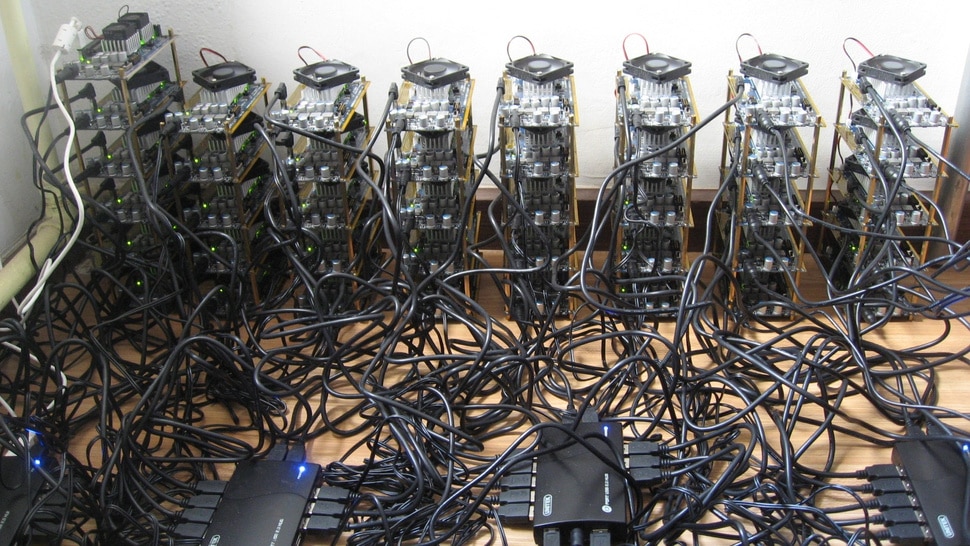

How Does Bitmining Work

Miners compete with their peers to zero in on a hash value generated by a crypto coin transaction, and the first miner to crack the code gets to add the block. Mining also ensures that no one entity is in control of the blockchain or protocol that governs it, making Bitcoin resistant to being controlled (or shut down). Crypto miners use specialized, high-energy computers, aka nodes. These computers use trial and error, guessing repeatedly until they find a solution. How Does Bitcoin Mining Work? The process begins with miners collecting pending bitcoin transactions and organizing them into blocks. These pending. Miners are shaping a decentralized network by means of their computers with installed bitcoin-mining software. This software contains the copy of an entire. How Does Bitcoin Mining Work? By ADAM HAYES | Updated Nov 21, TABLE OF CONTENTS. What is Bitcoin Mining? What Coin Miners Actually Do. Mining and Bitcoin. How does Bitcoin mining work? · 1. New transactions are broadcast to all nodes. · 2. Each node collects new transactions into a block. · 3. Each node works on. What the miners do is take a block, hash it and see what the result is. If the hash is too big, they change it a bit, there are some values they are allowed. Mining is the process by which networks of specialized computers generate and release new Bitcoin and verify new transactions. Mining is the process that. Miners compete with their peers to zero in on a hash value generated by a crypto coin transaction, and the first miner to crack the code gets to add the block. Mining also ensures that no one entity is in control of the blockchain or protocol that governs it, making Bitcoin resistant to being controlled (or shut down). Crypto miners use specialized, high-energy computers, aka nodes. These computers use trial and error, guessing repeatedly until they find a solution. How Does Bitcoin Mining Work? The process begins with miners collecting pending bitcoin transactions and organizing them into blocks. These pending. Miners are shaping a decentralized network by means of their computers with installed bitcoin-mining software. This software contains the copy of an entire. How Does Bitcoin Mining Work? By ADAM HAYES | Updated Nov 21, TABLE OF CONTENTS. What is Bitcoin Mining? What Coin Miners Actually Do. Mining and Bitcoin. How does Bitcoin mining work? · 1. New transactions are broadcast to all nodes. · 2. Each node collects new transactions into a block. · 3. Each node works on. What the miners do is take a block, hash it and see what the result is. If the hash is too big, they change it a bit, there are some values they are allowed. Mining is the process by which networks of specialized computers generate and release new Bitcoin and verify new transactions. Mining is the process that.

Cryptocurrency mining is a process that validates transactions and adds them to a blockchain. Miners use computational power to solve complex mathematical. Mining is fundamental to validating transactions – or blocks – on a blockchain such as Bitcoin. A new block can only be added to the blockchain once miners. Bitcoin mining essentially consists of solving (or attempting to solve) a simple cryptographic puzzle, which when solved, proves mathematically that a set of. Mining also ensures that no one entity is in control of the blockchain or protocol that governs it, making Bitcoin resistant to being controlled (or shut down). Mining involves solving complex mathematical puzzles. Miners' computers (called nodes) collect and bundle individual transactions from the past ten minutes (the. Nodes in the peer-to-peer bitcoin network verify transactions through cryptography and record them in a public distributed ledger, called a blockchain, without. El mining process It consists of miners competing to solve extremely difficult mathematical problems. The first to solve the problem adds a new block to the. Bitcoin Mining is the process by which new Bitcoin blocks are added to the blockchain. Bitcoin mining is a costly, energy intensive process due to Bitcoin's. There are two well-known methods to validate cryptocurrency transactions—aka consensus mechanisms. Blockchains like Bitcoin use proof of work (mining), which is. Bitcoin mining is the process for validating Bitcoin transactions and minting new coins. Since Bitcoin is decentralized, there's no central authority managing. The block chain is a shared public ledger on which the entire Bitcoin network relies. All confirmed transactions are included in the block chain. It allows. Bitcoin Mining Economics · Electricity cost per Bitcoin = Time required to mine one Bitcoin * Energy consumption * Cost = ~ years * days * 24 hours *. Bitcoin is not a physical or digital object. Rather, bitcoin (BTC) is a representation of value in the form of a record of ownership on the Bitcoin blockchain. Simply put, Bitcoin mining is the process that adds a new block to this chain. In order to successfully add a block, Bitcoin miners compete. Bitcoins are a cryptocurrency created through a process called 'mining', where miners are required to solve (mine) a complex mathematical puzzle before they can. How does Bitcoin mining work? Mining (blockchain mining, in general) leverages economic incentives to provide a reliable and trustless way of ordering data. What is bitcoin mining? · When a new transaction is made on the Bitcoin network, it is broadcast to all nodes in the network. · These nodes then. Bitcoin mining essentially consists of solving (or attempting to solve) a simple cryptographic puzzle, which when solved, proves mathematically that a set of. Bitcoin mining is the process that validates Bitcoin transactions and creates new bitcoins. It's a bit like solving a complex puzzle to win. Crypto mining is the process by which crypto miners use computers, data, codes, and calculations to validate crypto currency transactions and earn.

Vesting Finance

Understanding the details of your compensation structure is vital for comprehensive financial planning. When you know the ins and outs of your benefits, you can. View Vesting Finance (mbdou32-sakh.ru) location in Utrecht, Netherlands, revenue, industry and description. Find related and similar companies as. “Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. personal financeMoney EssentialsNew Rules for RetirementMoney MovesCalculatorsFinance Center There are two basic types of vesting (ask your benefits. Vesting is a legal term common to employer-provided benefits that means to give or earn a right to a present or future payment, asset, or benefit. Benefits. Select a role to explore the products and services that support the health, wellness, and financial security of our clients. Active Clergy; Retired. Highlights: In an employer-sponsored retirement plan like a (k), vesting refers to the percentage of contributions that the accountholder owns outright. In law, vesting is the point in time when the rights and interests arising from legal ownership of a property are acquired by some person. What is a Vesting Schedule? A vesting schedule is an incentive program established by an employer to give employees the right to certain asset classes. Understanding the details of your compensation structure is vital for comprehensive financial planning. When you know the ins and outs of your benefits, you can. View Vesting Finance (mbdou32-sakh.ru) location in Utrecht, Netherlands, revenue, industry and description. Find related and similar companies as. “Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. personal financeMoney EssentialsNew Rules for RetirementMoney MovesCalculatorsFinance Center There are two basic types of vesting (ask your benefits. Vesting is a legal term common to employer-provided benefits that means to give or earn a right to a present or future payment, asset, or benefit. Benefits. Select a role to explore the products and services that support the health, wellness, and financial security of our clients. Active Clergy; Retired. Highlights: In an employer-sponsored retirement plan like a (k), vesting refers to the percentage of contributions that the accountholder owns outright. In law, vesting is the point in time when the rights and interests arising from legal ownership of a property are acquired by some person. What is a Vesting Schedule? A vesting schedule is an incentive program established by an employer to give employees the right to certain asset classes.

Currently, employers have a choice of two different vesting schedules for employer matching (k) contributions. Your employer may use a schedule in which. The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment. Vesting Finance specializes in credit management and financial servicing within the financial sector. Use the CB Insights Platform to explore Vesting. We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi. We define “vesting” as the process by which an individual earns the right to own or exercise certain assets, such as shares, options, or other forms of equity. Vesting is the process by which an employee acquires a “vested interest” or stock option in their company. Vesting Finance Holding BV. SECTOR. Financials. INDUSTRY. Financial Services. SUB-INDUSTRY. Asset Management. INCORPORATED. 05/01/ ADDRESS. WEBSITE. Employee Retention: Vesting schedules encourage employees to stay with the company longer to achieve full ownership of benefits. Financial Planning. But you might not immediately see the financial benefits of receiving these such investments. Your retirement plan or shares must “mature” according to a. In law, vesting is the point in time when the rights and interests arising from legal ownership of a property are acquired by some person. Aruba Smart Workplace prepares finance specialist for business transformation Vesting Finance has come a long way since its foundation in Aruba Smart Workplace prepares finance specialist for business transformation Vesting Finance has come a long way since its foundation in Finance. Actuarial. Actuarial Valuations Studies and Policies. Reports. Annual Vesting with TMRS. Vesting is an important milestone in your city career. They were in one of the five industry groups with the most of these types of plans: wholesale trade; retail trade; finance, insurance, and real estate; legal. Vesting Finance is a company that provides credit management and financial services. It offers mortgages, loans, commercial real estate, pensions, debt. Vesting, You are immediately % vested in both your contributions and USG's financial concerns, improve your financial wellness and reach retirement goals. What Is Vesting? by Quicken March 19, Financial Terms. Share article: “Vesting” refers to the process by which you become the owner of the employer. Vesting Finance, part of Arrow Global, is providing Credit management and Financial services. What Does Vesting Mean? You Vest by: Having 7 ½ years of credited service Payments are process by the Finance Department and will be mailed to the. personal financeMoney EssentialsNew Rules for RetirementMoney MovesCalculatorsFinance Center How does vesting work exactly? (k)s & company plans.

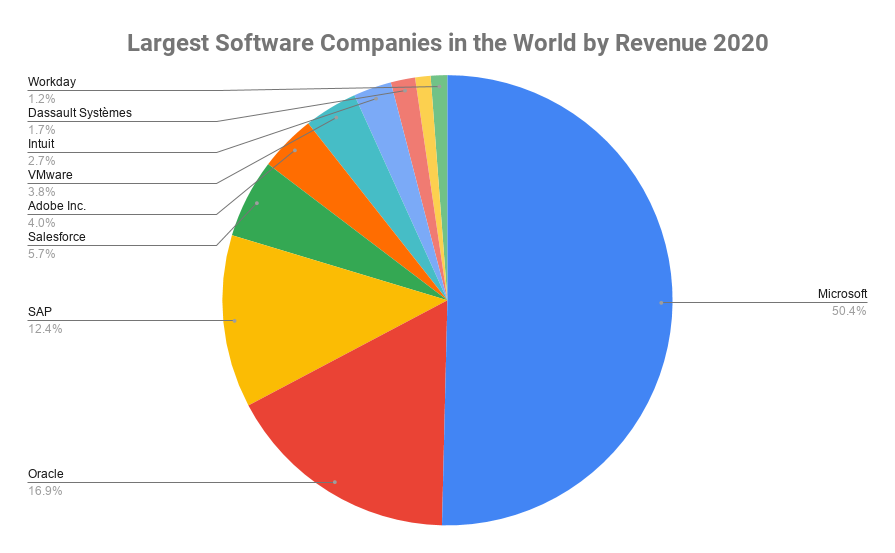

What Are The Top Software Companies

Top 50+ Software Development companies · Flexsin Technologies Avatar. Top Rated Plus. Close the tooltip. Top Rated Plus agencies are highly rated for work on. Top 18 Accounting Software Companies in the US · 1. NetSuite · 2. Intuit · 3. Workday · 4. BlackLine · 5. HighRadius · 6. Clearwater Analytics · 7. FloQast · 8. Top Software Companies (10,+) · Canva · Lowe's · Fulcrum GT · Tebra · Restaurant · GrayMatter Robotics · Stride Funding · Enverus. Big Data • Information. Brainhub · 10Clouds; N-iX; Miquido · Future Processing · CSHARK · TSH · Geniusee · S-Pro · Diceus. Top software development. CrowdStrike IT Outage Highlights Need for Robust Software Testing · Business Processes · Ecommerce · Insurtech · Artificial Intelligence · Cybersecurity · Sales. Below, we've listed the largest software companies in the world by market capitalization as of 10 Best Software Companies in the World · 1. Icreativez Technologies · 2. Sciencesoft · 3. Apple · 4. Google · 5. Amazon · 6. IBM · 7. Oracle. Top NYC, NY Software Companies (1,) · UL Solutions · Headway · Rokt · Citadel · Atlassian · Enfusion · Altice USA · Squarespace. Consumer Web • eCommerce •. Looking for reliable top software companies in USA? In our review list, you can find, compare and hire the best software developers in USA. Top 50+ Software Development companies · Flexsin Technologies Avatar. Top Rated Plus. Close the tooltip. Top Rated Plus agencies are highly rated for work on. Top 18 Accounting Software Companies in the US · 1. NetSuite · 2. Intuit · 3. Workday · 4. BlackLine · 5. HighRadius · 6. Clearwater Analytics · 7. FloQast · 8. Top Software Companies (10,+) · Canva · Lowe's · Fulcrum GT · Tebra · Restaurant · GrayMatter Robotics · Stride Funding · Enverus. Big Data • Information. Brainhub · 10Clouds; N-iX; Miquido · Future Processing · CSHARK · TSH · Geniusee · S-Pro · Diceus. Top software development. CrowdStrike IT Outage Highlights Need for Robust Software Testing · Business Processes · Ecommerce · Insurtech · Artificial Intelligence · Cybersecurity · Sales. Below, we've listed the largest software companies in the world by market capitalization as of 10 Best Software Companies in the World · 1. Icreativez Technologies · 2. Sciencesoft · 3. Apple · 4. Google · 5. Amazon · 6. IBM · 7. Oracle. Top NYC, NY Software Companies (1,) · UL Solutions · Headway · Rokt · Citadel · Atlassian · Enfusion · Altice USA · Squarespace. Consumer Web • eCommerce •. Looking for reliable top software companies in USA? In our review list, you can find, compare and hire the best software developers in USA.

Forbes ranks the world's top digital companies.

Popular startups, companies & organizations by highest day trend score: ; Cosm · $M · ; DecoverAI · $2M · ; Gcore · $60M · ; Intelmatix · $20M · Rokt is the global leader in ecommerce technology, enabling companies like Uber, Live Nation, AMC Theatres, PayPal, Hulu, Staples, and Lands' End to unleash. The Top 6 Services That Software Development Companies Provide · Custom Software Development · Web Application Development · Mobile Application Development · IT. Industry Overview. One third of the $5 trillion global information technology (IT) market is in the United States, making it the largest tech market in the. Apple Inc, Microsoft Corp, Alphabet Inc, mbdou32-sakh.ru Inc, and Meta Platforms Inc are the top 5 IT software companies in the world in by market. Top 11 Software Development Companies in the US () · 1. PieSoft · 2. eSparkBiz · 3. Elluminati Inc · 4. Solwey Consulting · 5. Rootstrap · 7. Troy Web. Table of Contents · 1. Imaginary Cloud · 2. Inventive Works · 3. Emergent Software · 4. Origami Studios · 5. One Beyond · 6. Accelerance · 7. GoodCore Software. For software engineers that want to move to the US. ; 6. Uber. ; 7. Tesla. ; 8. LinkedIn (Microsoft). ; 9. IBM. Top Colorado Software Companies (1,) · Skillsoft · Dropbox · Spectrum · FluentStream · VORTO · Peaksware · Duda, Inc. · Vivian Health. Healthtech • HR Tech •. Top San Francisco Bay Area, CA Software Companies (1,) · 2K · Atlassian · Benchling · Cisco Meraki · Capital One · Noyo · BigCommerce · Spotnana. Big Data •. The top-rated Custom Software Development companies on Clutch, based on customer reviews and ratings, include: Designli (5 stars, 54 reviews); You are launched. Top Software Development Companies · Filter Companies · Tata Consultancy Services · Intuit · Motorola Solutions · MathWorks · Yardi Systems · Atlassian. Best United States Software Development Firm Rankings · Naked Development. (11 reviews) · Diffco. (33 reviews) · Testmatick. (8 reviews) · Groovy Web. Find and hire top IT service providers for your next web, app and software requirements with us! Explore List of Top Software Development Companies in August. Top Boston, MA Software Companies () · Basis Technologies · Capital One · Simply Business · Atlassian · Formlabs · Geode Capital Management · AutoStore. List of the Top Software Development Companies in USA | Best Software Developers USA · SDLC Corp · instinctools · Think To Share · OpenXcell · Naked Development. The tech industry is a hotbed of innovation, and software companies stand at the forefront of this revolution. From giants like Microsoft. In conclusion, the top 10 global software companies represent the pinnacle of innovation and excellence in the IT industry. From established. top Software companies and startups in United States in August · Figma · Snyk · OpenAI · Flexbase · Replit · mbdou32-sakh.ru · Snowflake · mbdou32-sakh.ru · See full. Popular Software Development Companies in · 1. Binmile Technologies. Founded in , Binmile Technologies is a fast-growing global software outsourcing.

Bank Levy Meaning

A bank levy is a “one time hit”. It only puts a hold on money in your account at the time the levy is processed by the bank. Certain funds are exempt from levy. Levies are a specialized form of warrant and are generally used to withdraw funds from a taxpayer's financial institution account or garnish a taxpayer's wages. In the case of an IRS bank levy, the IRS takes money from your checking or savings account in order to satisfy your outstanding tax liability. A bank tax, or a bank levy, is a tax on banks which was discussed in the context of the financial crisis of – The bank tax is levied on the capital. We may levy against your bank accounts, requiring the bank to hold for 20 days all monies in your account up to the total past due tax, penalty, and interest. What Are the Limits on Levies and Garnishments? A bank levy doesn't mean you lose the money in your bank account. It only means it is frozen. The creditor. After you get a Writ of Execution, you can use it to ask that money be taken from the other side's bank account. This is called a bank levy. The IRS will initiate a levy on bank accounts not only as a means to collect the tax but also as an inducement to the taxpayer to make arrangements to pay the. An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account. A bank levy is a “one time hit”. It only puts a hold on money in your account at the time the levy is processed by the bank. Certain funds are exempt from levy. Levies are a specialized form of warrant and are generally used to withdraw funds from a taxpayer's financial institution account or garnish a taxpayer's wages. In the case of an IRS bank levy, the IRS takes money from your checking or savings account in order to satisfy your outstanding tax liability. A bank tax, or a bank levy, is a tax on banks which was discussed in the context of the financial crisis of – The bank tax is levied on the capital. We may levy against your bank accounts, requiring the bank to hold for 20 days all monies in your account up to the total past due tax, penalty, and interest. What Are the Limits on Levies and Garnishments? A bank levy doesn't mean you lose the money in your bank account. It only means it is frozen. The creditor. After you get a Writ of Execution, you can use it to ask that money be taken from the other side's bank account. This is called a bank levy. The IRS will initiate a levy on bank accounts not only as a means to collect the tax but also as an inducement to the taxpayer to make arrangements to pay the. An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account.

A creditor can take part of your wages directly from your paycheck with a wage garnishment. A levy allows a creditor to withdraw funds from your bank account. Levies are the legal means by which a taxing authority or a bank can seize property for the debt. Property seized in a levy includes cash, cars, houses, and. Delinquent Tax · Single action levy – allows the department to take only the amount of funds you have access to at the time the financial institution receives. A bank levy occurs when a creditor instructs a bank to take money from another's account without the consent of that person, the account holder. A bank levy is a collection technique creditors use to recover money owed. Some creditors, like the IRS, have a statutory right to collect using a bank levy. A bank levy is when a sheriff is authorized to take funds from the debtor's bank account(s) to pay you. The first step in this process is to complete a bank. How Do Bank Garnishments Work? · First, the judgment creditor will ask the court for a bank garnishment. · A writ of the garnishment is served on your bank. · The. The bank levy was introduced in It is an annual charge on certain balance sheet liabilities and equity of banks and building societies. To levy the account, the creditor serves your bank with a legal document known as a Writ of Garnishment. Upon receiving this writ, the bank freezes any money in. A bank levy is when the IRS or state taxing authority removes the amount of unpaid federal or state tax debt from the debtor's bank accounts. A bank levy is when the sheriff's office takes money from your bank account to pay the judgment creditor (person the judge ordered you to pay) or debt. A levy is a legal order requiring a third party, usually your bank, to remove money from your account and turn it over to the judgment creditor or collection. The Department may issue a tax levy against the wages or bank account of any taxpayer who has failed to pay their taxes after a Final Notice and Demand for. However, in a bank levy, it is not a government agency that attempts to collect the debt. In the case of bank levies, any creditor who is owed debt can request. A bank levy is a popular solution for creditors pursuing unpaid debt. After the creditor has received a lawsuit judgment, they can request a levy with your bank. Garnishments and levies both allow creditors to obtain payments from your paycheck or bank accounts. What Is a Levy? A tax levy or bank levy refers to the. A levy may be a fine or tax imposed by a government authority. In this case, levy can also be used as a verb, as in “to levy taxes” which means to impose a. Intangible assets: The SCDOR may issue a levy against the bank accounts and certain investment accounts of an individual or entity with an unpaid assessment or. A processing fee of $ is charged to your account upon receipt of a garnishment or tax levy. If there's not enough funds to cover the fee and the amount to. If a levy is placed on your bank account and you continue to deposit money into it, that money may also be seized by the creditor. Government agencies are more.